BUSHINGS MARKET OVERVIEW

Foreword from the Editor in Chief

Once again Hassan Zaheer and his team deliver, this time with Azhar Fayyaz’s report on the global trends for the middle voltage bushings market. But Azhar goes beyond mere reporting of numbers, providing great insight and information on bushings themselves, and how differing technologies create differing results. As a reliability professional, as well as transformer advocate, I greatly appreciate this welcome approach.

Introduction

Both power and distribution transformers are the most critical and expensive assets of any power system, and their failure leads to significant financial and, in worse cases, fatal losses. Due to urbanization, industrialization and electrification, global demand for energy is on the rise, overloading the network and eventually jeopardizing the reliability of power supply. Therefore, utilities are bent on, more than ever before, assessing the operating conditions of transformers as well as their components with a special focus on insulation system to minimize the failure risks and avoid unplanned power outages.

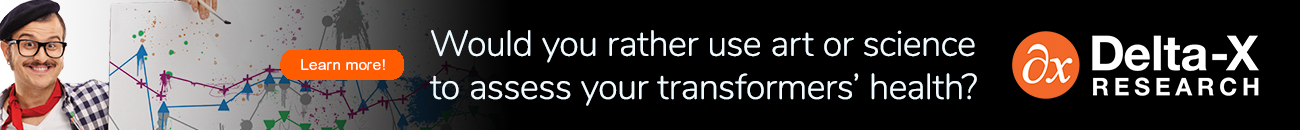

Figure 1. Reasons for transformer failures. Source CIGRE [1]

Bushings, one of the essential components of transformers are the third major cause of transformer failures, after tap-changers and windings failure [1], as shown in Figure 1. Despite being a relatively low-cost component (accounting for only ~5% of the total transformer price), bushings ensure safe operation of a comparatively high value asset. They connect the transformer windings to the inlet or outlet conductors while providing an insulation resistance between the live conductor and grounded transformer body.

According to a transformer reliability survey conducted by CIGRE, nearly 17% transformer failures are caused by bushings fault, 30% of which resulted in fire incidents and 10% in explosions [1]. Bushings have a high failure rate because they are subjected to strong electric field intensity resulting from high potential difference at a close distance between HV terminals and the grounded body. Realizing its importance, many utilities and power generation companies are pursuing preventive maintenance of bushings by proactively monitoring their aging and degradation, even if it is complex and quite expensive.

Key Technology Trends in Transformer Bushings

Bushings are generally designed to minimize field stress by uniformly distributing electric field intensity in both radial and axial directions when passing through the grounded metallic flanges. For this HV bushings typically employ capacitance-graded design i.e. their core is formed by wounding different layers of paper insulation with metallic foils to optimally distribute the electric field.

There are three different types of HV bushings: Oil Impregnated Paper type (OIP), Resin Impregnated Paper Type (RIP) and Resin Bonded Paper Type (RBP). MV and LV bushings, on the contrary, are composed of hollow porcelain housing filled with resin or transformer oil surrounding the current carrying conductor.

RIP Bushings

Almost 65-75% of the bushings installed in the market are OIP, however trend is slowly shifting towards RIP.

Despite being a relatively low-cost component, accounting for only ~5% of the total transformer price, bushings ensure safe operation of a comparatively high value asset.

In RIP bushings, the paper insulation is placed inside a housing after impregnation with epoxy resin, thus resulting in gas tight and void free product. RIP bushings are relatively higher in cost compared to OIP and RBP type, but this cost difference is easily compensated by added benefits such as better thermal advantages and oil free solution.

Composite Housings

Porcelain and the silicon based composite insulators are the most common materials used to design housings for transformers bushings. Most of the bushings currently in service are porcelain based, but composite insulators have significantly increased their market share in the recent years successfully penetrating developed markets due to the following advantages:

-

Due to hydrophobic nature of silicon, composite housings can operate under heavily polluted environment without compromising the performance, thus minimizing the maintenance cost.

-

Being lightweight and less fragile, they are easy to handle and assemble during in-house installations.

-

They have very short lead times compared to their counterparts, porcelain housings.

-

Inherent safety features of composite housings, owing to their design and manufacturing technology, prevent explosion in case of a fault thus ensuring the safety of workers and public in the vicinity.

Online Condition Monitoring of Transformer Bushings

Statistics identify bushings faults as the major reason for transformer failures, thus incentivizing the operators to continuously monitor integrity of the bushing’s insulation. Also, bushings are usually as old as transformers themselves, which makes it essential to continuously monitor them in decades-old grid infrastructures. Another reason for utilities to adopt online condition monitoring is the recent shifting trend towards smart grid infrastructure.

While there are several online monitoring techniques have been developed over the years, periodic offline testing still plays the dominant role. Most commonly employed tools for online detection of incipient faults in transformers bushings are electrical tests, such as capacitance, partial discharge, and dissipation factor (tgδ) measurements.

Global MV Transformers Bushings Market

Global Market Overview

Bushings demand is directly coupled with transformers market as transformers are one of the major applications of bushings. Globally, the primary market driver for transformers bushings is the increasing demand for a stable and reliable power supply. High penetration of the renewables and electric vehicles (EVs) charging infrastructure at MV level has been instigating major grid expansion projects worldwide. Also, high replacement rates to refurbish aged grid infrastructure from developed countries, along with increasing electrification and urbanization from developing countries are to further spur the demand for transformers bushings. APAC market is by far the biggest market of MV transformers bushings globally, followed by Americas market. Most of the growth in APAC region is attributed to grid expansion plans by utilities to cater for the increase in generation capacity. However, in developed regions of Europe and Americas, replacement plans by utilities to enhance system reliability are primarily instigating the bushings market.

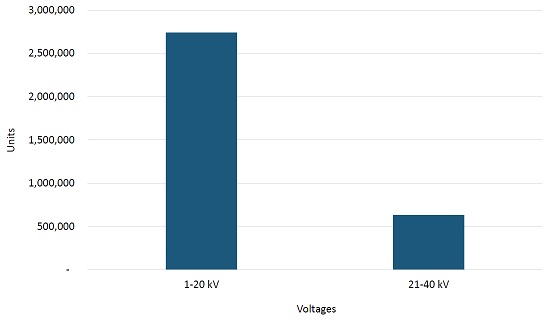

The combined distribution transformers bushings market for Europe, Middle East, and Africa (EMEA) region observed a total sale of 2.56 million units in 2019

EMEA Bushings Market 2019

The combined distribution transformers bushings market for Europe, Middle East, and Africa (EMEA) region observed a total sale of 2.56 million units in 2019, 57% of which was captured by Europe alone. Biggest markets in the Europe are Germany and UK, while Saudi Arabia and South Africa are the leading markets in Middle East and Africa, respectively.

Figure 2. Key EMEA markets. Source: Power Technology Research [2]

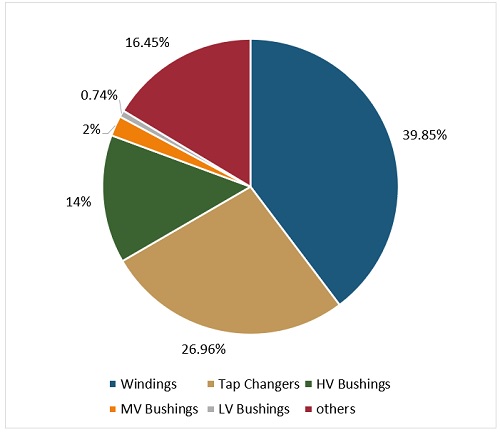

Figure 3. EMEA distribution transformers bushings market (units). Source: Power Technology Research [2]

Figure 3. EMEA distribution transformers bushings market (units). Source: Power Technology Research [2]

Transformers bushings market in Europe is primarily replacement driven, especially in Nordic region where the emphasis is to replace 40-year-old grid infrastructure. Renewables penetration and installation of EV charging infrastructure in the Western European countries is also instigating the expansion of distribution grids, consequently driving the bushings market.

Key market drivers in the Middle East, especially GCC countries are large infrastructure projects planned in the region to develop it as a financial and tourism hub to diversify the economy and lessen its reliance upon oil resources. Also, for the first time in history of Saudi Arabia, the biggest market in the Middle East, large renewable energy projects planned under Vision 2030 are to instigate a demand for distribution transformers bushings. New power generation projects, capacity expansions in grid to accommodate power injection and increased electrification are to majorly drive the bushings market in Africa. Figure 2 depicts some of the major markets studied in the region for analysis.

Americas Bushings Market 2019

Bushing’s volume for both North and South America was 3.37 million units in 2019. USA was the largest market in the region with a total sale of 1.35 million units.

According to U.S department of energy, nearly 70% of the transmission and distribution equipment in US grid is more than 25 years old. Replacement of these units will fuel the demand for bushings.

Bushings market in USA, the biggest market of North America is primarily driven by government initiatives to revamp electrical infrastructure [3], [4].

Unlike North America, greenfield market overshadows replacement market in South America as most of the utilities have adopted failure replacements approach rather than preventive replacements. Distribution companies in the region plan to invest heavily in the expansion of the grid to cope with the planned generation capacity additions.

Figure 4. Americas distribution transformers bushings market (units). Source: Power Technology Research [2]

Figure 5. Key Americas markets. Source: Power Technology Research [2]

Also, electrification remains the key investment driver in the region. Even though the current electrification in Brazil is close to 98%, the topic remains a major reason for investments in the grid. Figure 5 shows the markets in the region presenting the highest opportunity based on a myriad of reasons along with market sizing.

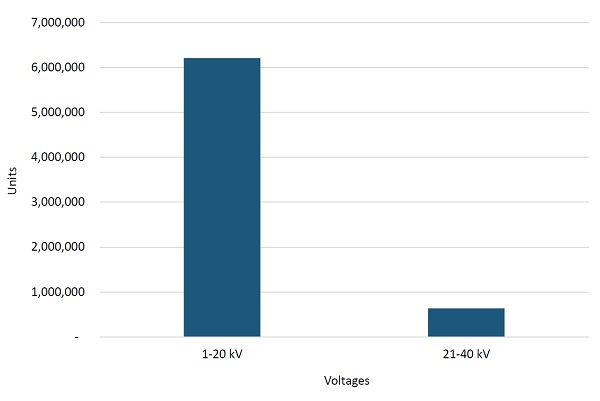

APAC Bushings Market 2019

In 2019, ~6.84 million units of MV transformer bushings were sold in APAC. China, as expected, was the biggest market in the region with 37% market share, followed by India at 22%. It is also noteworthy that China is not only the largest market in the region but also globally.

Figure 6. APAC distribution transformers bushings market (units). Source: Power Technology Research [2]

Figure 6. APAC distribution transformers bushings market (units). Source: Power Technology Research [2]

Figure 7. Key APAC markets. Source: Power Technology Research [2]

Figure 7. Key APAC markets. Source: Power Technology Research [2]

Electrification and urbanization are the two key factors driving the greenfield investments in the distribution grid for APAC. Additionally, developments in power generation sector also require capacity additions in the distribution grid for countries like China, India, and Indonesia thus fueling the demand for bushings. High number of failure replacements in India and environment driven replacement programs in China are also a major driving factors for the distribution transformers bushings market. Figure 7 shows some of the key markets in APAC region to keep an eye on in future years.

Conclusion

Bushings are a critical part of transformers, and their failure can not only lead to total loss of a transformer but also to a loss of many other equipment in the surrounding. Thus, it is of paramount importance to continuously monitor bushings condition to increase system reliability. Also, online condition monitoring has become the key objective for many utilities as part of their smart grid initiatives.

Future market demand for transformer bushings looks promising as most of the utilities are upgrading and expanding their MV distribution network owing to increased penetration of renewables and EVs into the grid infrastructure. Steady growth is expected from APAC and South America markets where electrification is high on agenda. Major infrastructure and power generation projects in MEA region are to further drive the future bushings market. However, Europe and North America markets are expected to see a combination of both greenfield and brownfield additions in the coming years.

Bushings market demand in 2020 has also been impacted badly by the COVID-19 pandemic. Supply, however, was comparatively less affected as most of the manufacturing facilities continued production except for 1-2 weeks when COVID-19 impact was at peak in a country and strict lockdown was implemented. Moving forward, market is expected to bounce back from Q1 of 2021.

With the advent of renewable energy, Western European countries are concerned about grid reliability and are planning to introduce stricter grid compliance codes, thus more utilities are expected to adopt online monitoring techniques. OEMs offering turnkey asset management solutions can capitalize this opportunity by targeting these markets.

References

-

S. Tenbohlen, "Transformer Reliability Survey," 2011

-

"Distribution Transformers Global Market Analysis," Power Technology Research, 2019

-

U. D. o. Energy, "2019 Grid Modernization Lab Call Awards," available at https://www.energy.gov/2019-grid-modernization-lab-call-awards

-

U. D. o. Energy, "EurekAlert!," 25 November 2019, available at https://www.eurekalert.org/pub_releases/2019-11/dnl-doe112519.php

-

K. Chamberlain, 23 March 2019, available at https://thenextweb.com/podium/2019/03/23/us-smart-grids-electricity-economy/

Bushings market demand in 2020 has also been impacted badly by the COVID-19 pandemic. Supply, however, was comparatively less affected as most of the manufacturing facilities continued production except for 1-2 weeks when COVID-19 impact was at peak in a country and strict lockdown was implemented. Moving forward, market is expected to bounce back from Q1 of 2021.

Azhar Fayyaz

Azhar Fayyaz is a Market Analyst at Power Technology Research. He is involved in projects on the power grid topics at Power Technology Research gathering data on network structure of distribution utilities, estimating the installed base of T&D equipment and analyzing the information to predict future market trends. As a market analyst at PTR, he performs competitive analysis of different companies operating in a region and determine their market share for a specific product. He also has more than 2 years of experience working as a senior shift engineer at Chashma Power Generation Station. Azhar has a M.Sc. in Power Engineering from Pakistan Institute of Engineering & Applied Sciences.